China is going to fall a long way short of its ‘Made in China 2025’ target for domestic semiconductor production, says IC Insights.

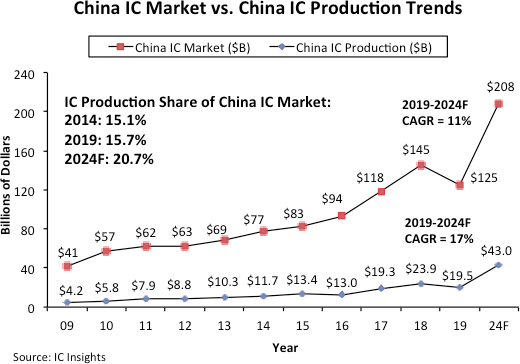

IC production in China represented 15.7% of its $125 billion IC market in 2019, up only slightly from 15.1% five years earlier in 2014.

As shown in Figure 1, IC Insights forecasts that this share will increase by 5.0 percentage points to 20.7% in 2024 (one percentage point per year on average).

Figure 1

A very clear distinction should be made between China’s IC market and indigenous IC production in China.

As IC Insights has oftentimes stated, although China has been the largest consuming market for ICs since 2005, it does not necessarily mean that large increases in IC production within China would immediately follow, or ever follow.

Of the $19.5 billion worth of ICs manufactured in China last year, China-headquartered companies produced only $7.6 billion (38.7%), accounting for only 6.1% of the country’s $124.6 billion IC market.

TSMC, SK Hynix, Samsung, Intel, and other foreign companies that have IC wafer fabs located in China produced the rest.

IC Insights estimates that of the $7.6 billion in ICs manufactured by China-based companies, about $1.8 billion was from IDMs and $5.8 billion was from foundries like SMIC.

If China-based IC manufacturing rises to $43.0 billion in 2024 as IC Insights forecasts, China-based IC production would still represent only 8.5% of the total forecasted 2024 worldwide IC market of $507.5 billion.

Even after adding a significant markup to some of the Chinese foundry producers’ IC sales, China-based IC production is still likely represent only about 10% of the global IC market in 2024.

2019

Worldwide IC Market ($B) $358.4

China IC Market ($B) $124.6

China-based IC Production ($B) $19.5

% of WW IC Market 5.4%

% of China IC Market. 15.7%

China-HQ IC Production ($B) $7.6

% of total China IC Production 38.7%

% of WW IC Market 2.1%

% of China IC Market 6.1%

Currently, IC production in China is forecast to exhibit a very strong 2019-2024 CAGR of 17%. However, considering that China-based IC production was only $19.5 billion last year, this growth is starting from a relatively small base.

In 2019, SK Hynix, Samsung, Intel, and TSMC were the major foreign IC manufacturers that had significant IC production capability in China.

Even with new IC production being established by China startups YMTC and CXMT, IC Insights believes that foreign companies will be a large part of the future IC production base in China.

As a result, IC Insights forecasts that at least 50% of IC production in China in 2024 will come from foreign companies such as SK Hynix, Samsung, Intel, TSMC, UMC, and Powerchip with fabs in China.

In the wake of tariffs and trade tension between China and the United States, government officials and company representatives throughout China have doubled down on their resolve to quickly and meaningfully grow the nation’s domestic IC business in order to reduce its dependence on critical IC components currently supplied by companies based in the U.S. and other countries.

In the memory IC market specifically, some headlines and reports last year proclaimed that China is “unstoppable” and will soon match the output and technology level of Samsung, SK Hynix, and Micron. When those types of claims emerge, a reality check is in order.

Consider that China’s first indigenous DRAM supplier, Changxin Memory Technologies (CXMT), only began limited production of its first DRAM products in 4Q19.

This company has a few thousand employees and a capital spending budget of about $1.5 billion per year. In contrast, Micron and SK Hynix each have well over 30,000 employees and Samsung’s memory division is estimated to have over 40,000. Moreover, in 2019, the combined capital spending from Samsung, SK Hynix, and Micron was $39.7 billion. Now that’s a reality check!

While China continues to make large investments in its memory manufacturing infrastructure and has developed some clever design innovations in an attempt to avoid potential patent disputes, IC Insights remains extremely skeptical whether the country can develop a large competitive indigenous memory industry even over the next 10 years that comes anywhere close to meeting its memory IC needs.

One major issue that many observers overlook with regard to China becoming more self-reliant for its IC needs is its lack of indigenous non-memory IC technology. Currently, there are no major Chinese analog, mixed-signal, server MPU, MCU, or specialty logic IC manufacturers. Moreover, these IC product segments, which represented over half of China’s IC market last year, are dominated by well-entrenched foreign IC producers with decades of experience and thousands of employees.

While everyone is focused on China’s moves in the memory market, becoming self-reliant in non-memory IC segments poses an even more difficult problem for China. In IC Insights’ opinion, it will take decades for Chinese companies to become competitive in the non-memory IC product segments.

Currently, China is putting on a brave face with regard to its future IC industry capabilities. However, given the extremely small and undeveloped starting base of Chinese company IC production and technology today, and with increasing difficulty to purchase advanced semiconductor manufacturing equipment, IC Insights believes it is essentially impossible for China to make significant strides in becoming self-sufficient for its IC needs (memory and non-memory) within the next 5 years and probably not even within the next 10 years.

From:electronicsweekly